1. Can foreigners register companies in Singapore?

Yes. Any foreigner over 18 years old can register a Singapore company without needing citizenship or permanent residency. At least one local Singapore director must be appointed (we provide nominee director services).

2. How long does company registration take?

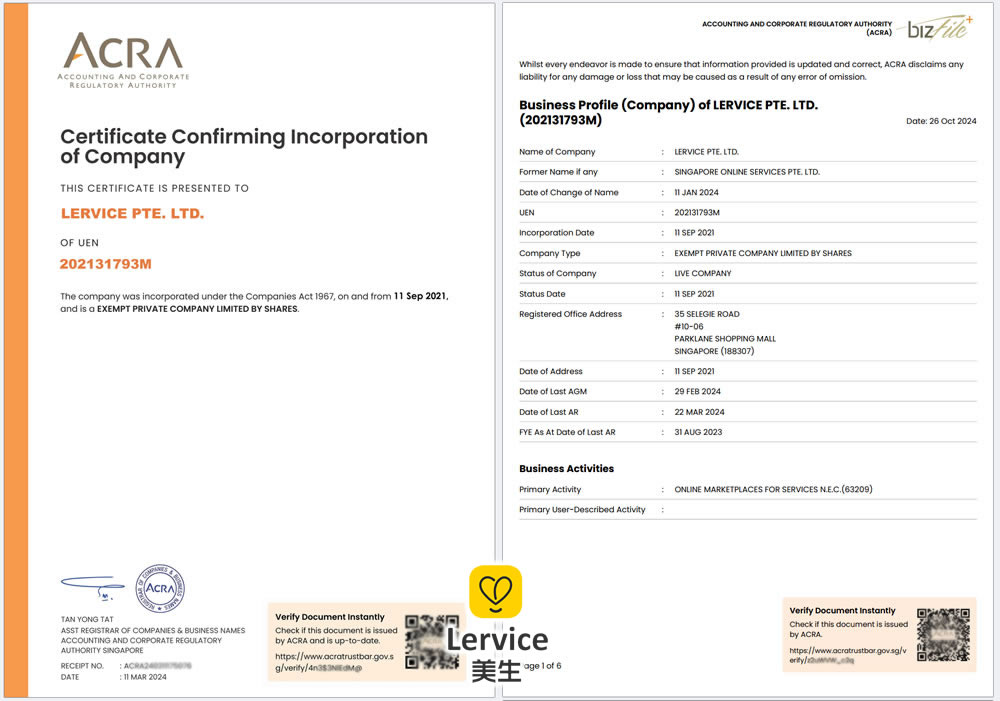

Usually 1-2 working days to complete registration (with complete documents). After registration, a BizFile certificate will be issued.

3. What documents are required for registration?

Company name, registered and paid-up capital, ID/passport copies and contacts of directors and shareholders, description of main business activities.

4. What types of companies are there in Singapore?

The most common is the Private Limited Company, suitable for over 95% of enterprises. It has separate legal personality, limited liability, and enjoys lower tax rates.

5. What compliance obligations come after registration?

Main obligations include:

- Annual Return submission

- Appointment of company secretary

- Keeping accounting records and filing taxes

- Audits or GST registration if applicable

6. Can remote registration be done? Is physical presence required?

Absolutely. We support video verification and electronic signatures; no need to be physically present in Singapore.

7. Can a bank account be opened after company registration?

We assist in opening corporate bank accounts in Singapore or overseas, such as OCBC, DBS, UOB, or recommend digital bank solutions (Anext, Wise, Airwallex, etc.)

8. Can an Employment Pass (EP) be applied for after company registration?

We can apply for Singapore Employment Pass (EP) for shareholders or directors, and dependent passes for parents, spouse, and children, enabling three generations to live long-term in Singapore. Please click "Immigration Services" in the navigation for details.

9. What is the tax policy for Singapore companies?

Summary of Singapore corporate tax policy:

1. Corporate tax rate:

Uniform 17% tax rate (industry independent), actual tax burden often lower due to exemptions and reliefs

2. New company tax exemptions (within 3 years):

For qualifying new companies (locally registered, resident), first SGD 100,000 profit 100% tax exempt; next SGD 100,000 profit 75% exempt; effectively only ~4.25% tax on first SGD 200,000

3. Foreign income tax exemption:

Foreign-sourced income such as dividends, service income, branch profits are usually not taxed if not remitted to Singapore; remittance may be exempt or credited

4. No capital gains tax:

Capital gains such as asset or stock sales are not taxed

5. No dividend tax / tax-free shareholder dividends:

Dividends paid to shareholders are tax exempt, regardless of individual or corporate status

6. GST (Goods and Services Tax):

VAT-like tax, current rate 9% (from 2024). Companies with annual turnover exceeding SGD 1 million must register and file GST. Input GST can be offset against output GST.

Summary:

Singapore is a world-renowned low-tax jurisdiction, ideal for startups, cross-border e-commerce, holding companies to establish headquarters or operational platforms.

10. What is an Exempt Private Company (EPC) in Singapore?

Exempt Private Company (EPC) is a common Singapore company type, suitable for SMEs and startups. Shareholders must be natural persons and not exceed 20. If annual turnover is below SGD 5 million, audit exemption applies. EPC enjoys tax benefits, flexible registration, low maintenance costs, and is one of the most popular registration choices.

11. Do Singapore companies need annual audits?

Yes, all companies must submit Annual Returns yearly. Audit exemption applies if turnover is below threshold, but financial records and reports must be maintained.

12. What certificates are issued after company registration?

The most common is the BizFile from ACRA, containing detailed info such as company name, address, shareholders, directors. Then there is the Certificate of Incorporation showing only name, registration number, date, and company type. Others include Certificate of Good Standing and Constitution. Only the BizFile is free from ACRA; others require paid downloads. All Singapore company certificates are PDF e-documents, printable in color.